GloNews10

Autonomous Driving Boom 2026: BMW, Tesla, and Waymo Lead the Charge in Self-Driving Cars

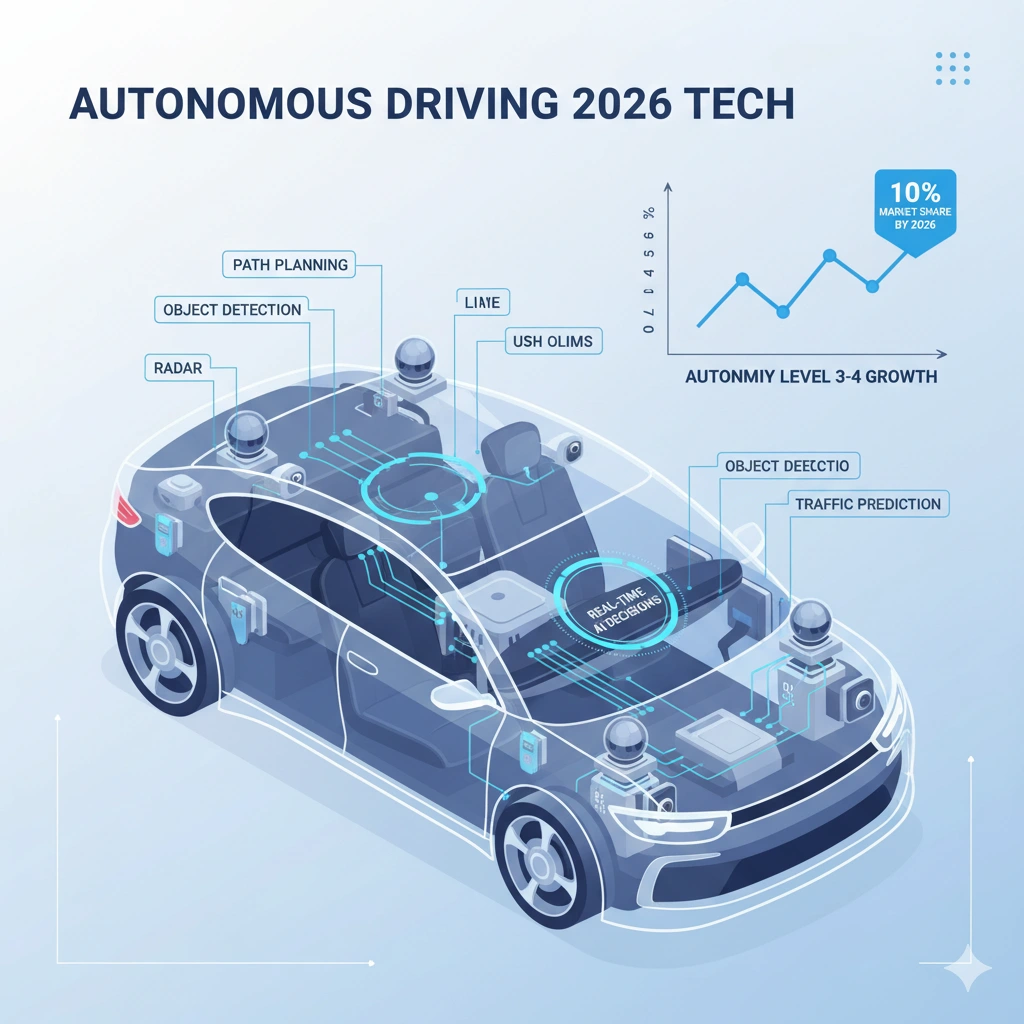

The automotive world is accelerating toward a future where hands-off highways become the norm, and autonomous driving 2026 promises to redefine mobility. As self-driving cars evolve from sci-fi dreams to everyday reality, industry giants like BMW, Tesla, and Waymo are ramping up innovations set to hit roads by 2026.

With Level 3 and Level 4 autonomy—where vehicles handle most driving tasks without human input—gaining regulatory green lights, this shift could slash accidents by 90% and unlock $7 trillion in economic value globally by 2030. But amid excitement, challenges like safety ethics, infrastructure gaps, and cyber threats loom large.

This deep dive explores how autonomous driving 2026 will transform commuting, logistics, and urban planning. From BMW’s Neue Klasse EVs with built-in AI pilots to Tesla’s robotaxi fleets and Waymo’s expansion, we’ll break down the tech, timelines, and what it means for drivers eyeing the next big upgrade in self-driving cars.

The buzz around autonomous driving 2026 stems from rapid AI advancements and maturing sensor tech. In 2025, Level 2+ systems (like GM’s Super Cruise) already assist on highways, but 2026 flips the script with true autonomy. Deloitte’s 2025 Global Automotive Consumer Study reveals 65% of buyers now prioritize self-driving cars features, up from 45% in 2023, driven by desires for safer, less stressful rides.

Key enablers include:

Globally, S&P Global forecasts self-driving cars to capture 15% of new sales by 2027, with Asia leading via China’s NEV incentives and Japan’s robotaxi pilots. For consumers, this means fewer parking woes and more productive travel time—imagine working or napping on your commute.

BMW is betting big on self-driving cars with its Neue Klasse platform debuting in the iX3 by late 2025, fully autonomous by 2026. Featuring a quad-motor setup and 500-mile range, the iX3 integrates Level 4 autonomy for urban and highway use. Priced around $60,000, it targets luxury buyers seeking seamless integration with smart cities. BMW’s Heart of Joy OS uses AI to predict traffic, potentially reducing congestion by 20% in pilot zones.

Tesla remains the autonomy frontrunner, with Elon Musk teasing a 2026 robotaxi unveil powered by Full Self-Driving (FSD) v12.5. This self-driving cars ecosystem aims for unsupervised operation, turning personal vehicles into revenue-generating rideshares. By 2026, Tesla envisions 1 million robotaxis on U.S. roads, slashing ride costs to $0.20 per mile—half of Uber’s current rates.

Challenges? FSD’s beta phase has faced scrutiny over edge-case errors, but 2025 OTA updates promise 99.9% reliability. Tesla’s Dojo supercomputer trains on billions of miles of data, making autonomous driving 2026 a software-first play. For everyday users, this could mean owning a car that pays for itself, per Tesla’s economic models.

Waymo, Alphabet’s arm, is scaling quietly: By 2026, its Jaguar I-Pace fleet expands to 10 U.S. cities, offering on-demand self-driving cars. With 50 million autonomous miles logged, Waymo’s inductive charging and V2X communication set it apart for fleet ops.

Asia’s EV boom fuels autonomy: China’s BYD integrates L3 systems in 2026 Seagull models, while Honda’s 2026 Passport hybrid adds adaptive cruise that evolves to full self-drive. In Europe, the 2035 ICE ban accelerates autonomous driving 2026 adoption, with Audi’s 2026 A6 sedan featuring V6-assisted autonomy.

Emerging markets like India (Vedanta’s battery push) and Brazil (EV tax tweaks ending 2026) could see affordable self-driving cars via partnerships. However, IEA warns of subsidy phase-outs slowing progress in Southeast Asia.

For a closer look at regulatory shifts, explore IEA’s Global EV Outlook 2025, which ties autonomy to electrification trends.

Despite hype, self-driving cars face steep barriers. Safety remains paramount: NHTSA probes into Tesla incidents highlight AI’s limits in fog or construction zones. Cybersecurity risks—hacking a fleet could cause chaos—demand robust encryption, as per PwC’s 2025 trends report.

Infrastructure lags: Only 20% of U.S. roads have 5G for V2V comms, per Epicflow analysis. Ethical dilemmas, like trolley problems in AI decisions, spark debates. Plus, job shifts for drivers could displace millions in trucking and taxis.

OEMs counter with hybrids: Ford’s 2026 Mustang Raptor blends V8 power with autonomy assists, appealing to skeptics. Goldman Sachs predicts battery costs dropping to $80/kWh by 2026, enabling affordable autonomous driving 2026 tech.

Ready for autonomous driving 2026?

By 2026, self-driving cars could dominate 10% of urban miles, per Automotive Dive forecasts, boosting efficiency and cutting emissions 30%. With S&P’s 89.6 million global sales projection for 2025 rising in 2026, autonomy integrates with EVs and connectivity for “software-defined vehicles.”

Challenges aside, autonomous driving 2026 heralds safer, smarter roads. For drivers, it’s a leap toward freedom—less focus on the wheel, more on the journey. Watch BMW, Tesla, and Waymo; they’re steering us there.